GLADSTONE CAPITAL (GLAD)·Q1 2026 Earnings Summary

Gladstone Capital Q1 2026: NII Covers Dividend as Portfolio Hits $900M

February 5, 2026 · by Fintool AI Agent

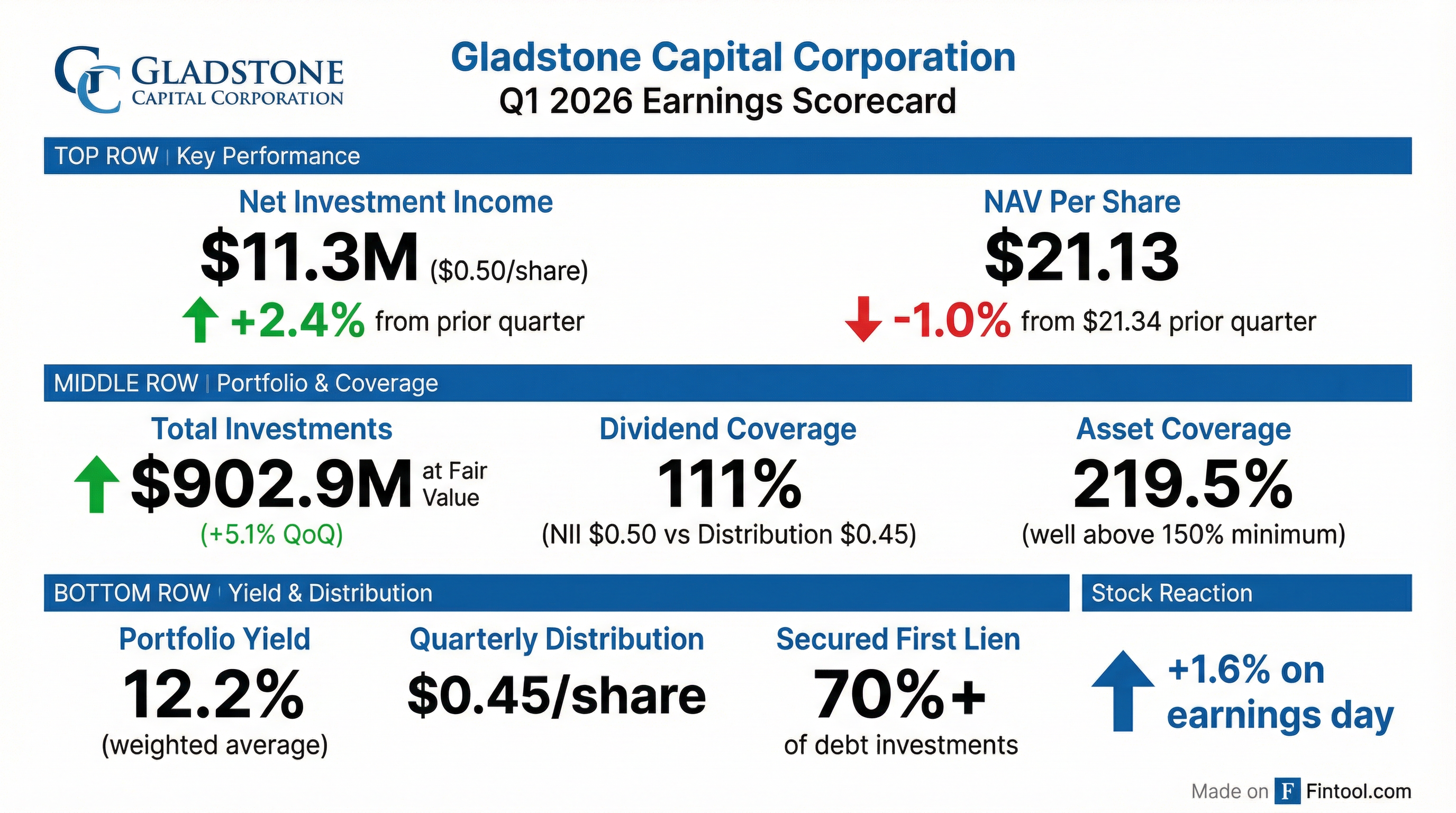

Gladstone Capital Corporation (NASDAQ: GLAD) reported fiscal Q1 2026 results for the quarter ended December 31, 2025, with total investment income of $24.5 million (up 2.4% QoQ) and net investment income of $0.50 per share, maintaining dividend coverage at 111% despite declining short-term interest rates.

The BDC's investment portfolio grew 5.1% to $902.9 million at fair value, with secured first lien debt remaining above 70% of the portfolio.

Did Gladstone Capital Beat Earnings?

Yes. GLAD delivered solid results that exceeded prior quarter performance:

Investment income increased primarily due to a $20.3 million rise in the weighted average principal balance of interest-bearing investments (to $772.3M from $752.0M), partially offset by a 30 basis point decline in weighted average yield from lower SOFR rates.

Other income jumped 270.5% quarter-over-quarter, driven by increases in prepayment fee income and success fees.

What Is the Dividend Coverage?

The core question for BDC investors: Is the dividend sustainable?

President Bob Marcotte confirmed sustainability:

"We closed out 2025 with a healthy increase in earning assets and were able to sustain our net interest income, lending spreads and dividend coverage despite the decline in short term interest rates. We expect this trend to continue into 2026 as we work through a healthy backlog of pending investments."

The 219.5% asset coverage ratio provides substantial headroom above the 150% regulatory minimum, giving GLAD flexibility for additional leverage if needed.

How Did the Stock React?

GLAD shares rose +2.1% on the earnings call day (Feb 5), building on the prior day's +2.0% move:

The positive reaction reflects investor comfort with management's detailed commentary on absorbing rate headwinds and the robust $100M+ investment pipeline. CFO Nicole Schaltenbrand noted the current distribution run rate is producing a yield of about 8.8%.

How Is GLAD Managing Rate Sensitivity?

The earnings call Q&A revealed detailed rate sensitivity mechanics:

Key Protection Mechanisms:

-

SOFR Floors: Average floor of ~1.25% on variable rate loans (current SOFR ~3.70%)

-

Commitment Fee Savings: Reduced from ~$2.6M annually to ~$1.0M run rate (saving ~$1.5-1.6M) by increasing line utilization

-

Spread Stability: No spread compression from competition — management emphasized: "we're not experiencing much in the way of spread compression last quarter, so competition is not driving it."

President Bob Marcotte on rate absorption:

"If you look at the big picture, based upon our average margin, our bank spread, and our marginal fees and costs, our general feeling is we can absorb most of the decrease and still be able to sustain the underlying dividend... We certainly are well positioned to absorb at least the first 50 and probably 75."

What Changed From Last Quarter?

Portfolio Activity: GLAD deployed $99.1 million during Q1 2026:

- $37.8M in two new portfolio companies

- $61.3M in existing portfolio companies

Credit Facility Expansion: Increased revolving line of credit commitment by $20.0 million during the quarter, with an additional $25.0 million expansion on February 3, 2026.

Net Asset Changes:

The sequential decline in net asset increase was driven by $5.6M of net unrealized depreciation, compared to $9.1M of appreciation in Q4 2025.

What Is the Investment Pipeline?

Management described a "surprisingly robust" pipeline for a traditionally slow Q1:

President Marcotte on the pipeline:

"The level of near-term investment opportunities we are working through in what is traditionally a slow Q1 is, frankly, a bit surprising. I would attribute this investment activity to the resilience of the lower middle market deal flows and the growth prospects within our existing portfolio."

Pipeline Composition:

- ~50% spillover from Q4 (extended diligence periods in current market)

- Strong domestic manufacturing and reshoring focus

- Defense contractor and precision manufacturing businesses seeing program activity

- Private equity sponsors being "vigilant on diligence" given market volatility and tariff concerns

AI/Data Center Exposure:

Management was asked about AI-related opportunities. Marcotte clarified GLAD does not directly invest in data centers but sees indirect exposure through portfolio companies:

"We don't directly invest in data centers. That's a big boys game... We do see some of the spend from those projects coming through in our portfolio. It might be bus bars that are going into data centers that, frankly, IMX does make."

Subsequent Events

Several notable developments occurred after quarter-end:

Portfolio Payoff: The $42.8M debt investment in Vet's Choice Radiology LLC paid off at par in January 2026, generating a prepayment fee of $855,000.

New Investment: GLAD invested $6.0M in IMX Power Holdings Inc. through secured first lien debt, with an additional $4.5M in unfunded commitments (line of credit and delayed draw term loan).

Preferred Stock Issuance: During Q1 2026, GLAD sold 440,665 shares of Series A Preferred Stock for gross proceeds of $11.0M and net proceeds of $9.9M. As of December 31, 2025, there were 1,302,077 preferred shares outstanding.

Distribution Schedule

Declared distributions for the upcoming quarter:

Common Stock:

Series A Preferred Stock:

Q&A Highlights: Credit Situations and PIK

The analyst Q&A provided transparency on specific credit situations driving unrealized depreciation and PIK income:

eegee's (Arizona QSR)

The quick-service restaurant investment faces unexpected headwinds:

"Things that are in border states or heavily Hispanic areas are facing significant downdraft associated with elevated ICE activities... Population, spend, economic drivers are all being impacted."

- Seasonal weakness (frozen drinks not strong in winter)

- New menu launch expected to drive traffic in 2026

- Management accelerating cost structure changes

Government Contractor (Army Corps Dredging)

One credit was impacted by the government shutdown, but management clarified this is temporary:

"There was an interruption or disruption in the Army Corps contracting for general maintenance services... That has already been corrected... whatever builds up and whatever dredging activity is going to have to be caught up down the road."

PIK Income Drivers

PIK income rose to $2.3M (9.6% of interest income), concentrated in two credits:

-

Growth Company: Scaling business with working capital needs — management monitoring EBITDA and enterprise value coverage

-

Restructuring Company: Liquidating underperforming segment — proceeds expected to deleverage and exit PIK

Notably, GLAD collected $2.8M of PIK during the quarter, so the accrued PIK balance actually declined.

Regulatory Environment (AFFE Rule)

On the AFFE (Acquired Fund Fees and Expenses) rule that limits institutional BDC investment:

"AFFE has been under discussion for what, 7 or 10 years now... I don't think there's anything particularly concrete. And frankly... it would take probably a number of years to roll out whatever might come. So we're not counting on that."

Forward Catalysts

-

Pipeline Execution: >$100M of late-stage deals should more than offset the $42.8M Vet's Choice prepayment — watch Q2 for deployment.

-

Rate Environment: Management confident in absorbing 50-75 bps of rate cuts; SOFR floors at ~1.25% provide downside protection.

-

Credit Workout: eegee's new menu launch in spring 2026 could drive traffic improvement; Army Corps dredging contract should normalize.

-

Commitment Fee Savings: ~$1.5-1.6M annual savings from higher line utilization should partially offset rate headwinds.

Key Takeaways

- Dividend Safe: 111% NII coverage with comfortable asset coverage margin; management confident in sustaining payout

- Rate Protection: Can absorb 50-75 bps of rate cuts via pipeline growth and commitment fee savings

- Robust Pipeline: >$100M late-stage deals, surprising for traditionally slow Q1

- Credit Transparency: eegee's facing border state headwinds; Army Corps dredging disruption temporary

- Stock Reaction: +2.1% on earnings call day as market gains comfort on rate sensitivity

Conference call held February 5, 2026 at 8:30 AM ET. Replay available through February 12, 2026 at (877) 660-6853, playback number 13757325.